Oil prices plunged more than 10 per cent on Friday as reports of a virulent new coronavirus variant sparked fears of more pandemic lockdowns and another blow to fuel demand, just as the US plans to release more supplies on to the market.

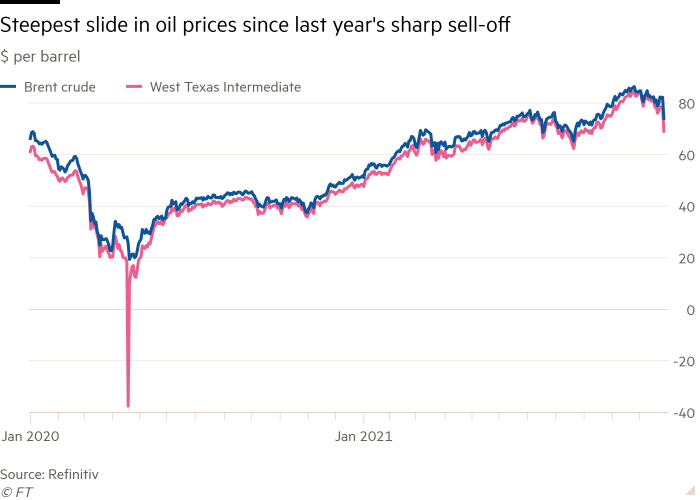

West Texas Intermediate, the American oil benchmark, dropped by 13 per cent to settle at $68.15 a barrel as US traders returned following the Thanksgiving holiday. The international benchmark Brent fell 12 per cent to settle at $72.72 a barrel.

Both of the oil markers had their biggest one-day declines since the WTI price briefly went negative in April 2020 at the height of the pandemic.

The falls in price came days after the White House, concerned about soaring petrol costs and widespread inflation, announced that it would release 50m barrels of crude from its Strategic Petroleum Reserve over the coming months — the biggest-ever drawdown of oil from the government stockpile — in conjunction with added contributions from five other countries.

The US announcement on Tuesday had little immediate effect on prices. But news of the B.1.1.529 Sars-Cov-2 variant, first identified in Botswana, has now overwhelmed sentiment.

“It obviously remains a wide-open question whether this new variant will truly pose a material threat to oil demand, with vaccination rates ratcheting steeply higher since the summer,” said Rory Johnston, managing director of Price Street, a research group. “But markets aren’t waiting to find out. Sell now, ask questions later.”

Last year’s lockdowns curtailed global demand by as much as 20 per cent during the worst phase. But the easing of restrictions, supply cuts by the Opec+ alliance of producing countries and heavy government stimulus spending has since sparked a recovery in oil prices, which have doubled since coronavirus vaccine breakthroughs were announced last November.

Other analysts said the sudden fall in oil prices could compel Opec+ to suspend planned supply additions — which have been unwinding the cuts made last year — when it meets next week.

The plunge in oil prices reflects “fear that the new variant will lead to widespread travel restrictions and lower oil demand”, said Neil Shearing of Capital Economics. “Opec are set to meet next week and these demand concerns could prompt them to delay or halt their planned gradual increase in supply.”

Analysts at Opec+ have already forecast that the oil market will tip into surplus in the first months of 2022 — and the excess could swell by 1.1m barrels per day in January and February if the US and other countries go ahead and inject 66m barrels of oil into the market through their planned stockpile release.

Friday’s sell-off would reinforce Opec+ leader Saudi Arabia’s reluctance to add too much more supply, analysts said.

“The oil market is understandably sensitive to news about new [coronavirus] variants, especially given the experience of 2020 and the run-up that oil prices have already seen,” said Martijn Rats, chief commodities strategist at Morgan Stanley.

But data pointing to rising mobility outside Europe, supply restraint from Opec, and weak spending on production by oil companies would remain supportive forces once the market had found its feet, he said.

Article From & Read More ( Oil prices drop more than 10% as virus variant threatens blow to demand - Financial Times )https://ift.tt/3FOZzAX

Business

Bagikan Berita Ini

0 Response to "Oil prices drop more than 10% as virus variant threatens blow to demand - Financial Times"

Post a Comment