(Bloomberg) -- Global stocks were mixed as M&A deals gave a boost to Europe, while worries about new virus variants and hurdles to the Biden administration’s stimulus proposal fanned a risk-off mood in the U.S. and Asia.

S&P 500 equity futures dropped, while Treasury yields climbed as President Joe Biden said he’s open to negotiating his $1.9 trillion Covid-19 relief proposal. On Monday, the top Senate Democrat said lawmakers said an aid package was unlikely before mid-March.

In contrast, European stock markets were almost uniformly green. Naturgy Energy Group SA soared 16% as asset manager IFM Global Infrastructure offered to buy a stake in the Spanish utility. Sweden’s EQT AB, one of Europe’s biggest private equity firms, jumped 10% after agreeing to take over Exeter Property Group in a $1.9 billion deal.

Asia took the brunt of the selling on Tuesday as China’s central bank withdrew cash from the banking system and an official cautioned about asset bubbles. The MSCI Asia Pacific Index sank most in two months and internet giant Tencent Holdings Ltd. lost 6.3%.

Adding to the backdrop of market worries was more negative news about the pandemic. Vaccine coverage won’t reach a point that would stop transmission of the virus in the foreseeable future, the World Health Organization said. German Chancellor Angela Merkel told party colleagues the potential threat from faster-spreading variants means the country is “sitting on a powder keg,” according to Bild newspaper.

“There are some negative news on lockdowns, new virus variants, and questions about vaccine efficacy,” said Mark Nash, head of fixed-income alternatives at Jupiter Asset Management. “That’s not a good combination for markets expecting a perfect world.”

These are some key events coming up in the week ahead:

Microsoft Corp., Apple Inc., Tesla Inc., Facebook Inc. and Samsung Electronics Co. are among companies reporting results.Data on U.S. home prices and consumer confidence come Tuesday.The Federal Open Market Committee monetary policy decision and briefing by Chair Jerome Powell are scheduled for Wednesday.Fourth-quarter GDP, initial jobless claims and new home sales are among U.S. data releases Thursday.U.S. personal income, spending and pending home sales come Friday.

These are the main moves in markets:

Stocks

Futures on the S&P 500 Index dipped 0.2% as of 8:52 a.m. London.The Stoxx Europe 600 Index gained 0.5%.The MSCI Asia Pacific Index declined 1.4%.The MSCI Emerging Market Index declined 1.7%.

Currencies

The Bloomberg Dollar Spot Index advanced 0.1% to 1,125.98.The euro was little changed at $1.2138.The British pound decreased 0.3% to $1.3639.The Japanese yen was little changed at 103.77 per dollar.

Bonds

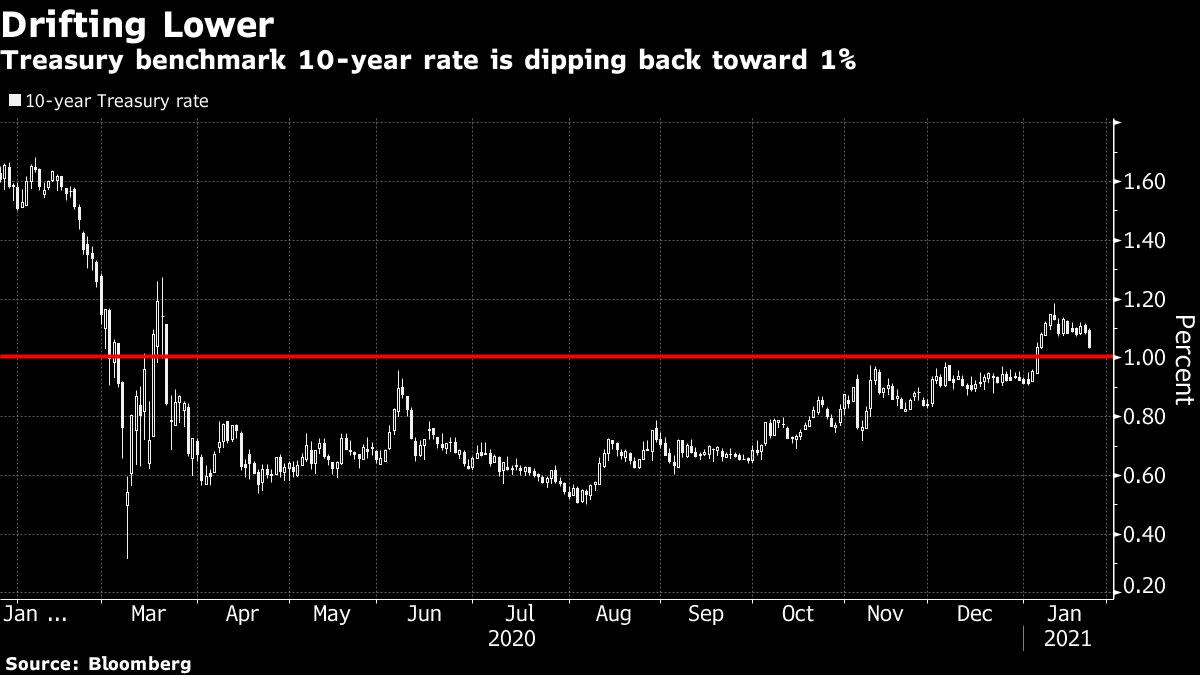

The yield on 10-year Treasuries climbed one basis point to 1.04%.The yield on two-year Treasuries gained one basis point to 0.12%.Germany’s 10-year yield increased one basis point to -0.54%.Britain’s 10-year yield gained one basis point to 0.271%.

Commodities

West Texas Intermediate crude fell 0.3% to $52.75 a barrel.Gold weakened 0.1% to $1,854.94 an ounce.

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.

Article From & Read More ( Stocks Trade Mixed as Dollar, Treasury Yields Rise: Markets Wrap - Yahoo Finance )https://ift.tt/3a5xRl9

Business

Bagikan Berita Ini

0 Response to "Stocks Trade Mixed as Dollar, Treasury Yields Rise: Markets Wrap - Yahoo Finance"

Post a Comment