An unlikely company has found itself at the centre of a much-heralded sea change in investment trends, as video game retailer GameStop’s stock continues to skyrocket – at least for now.

But the bizarre spectacle around the surge in the US consumer electronics firm’s share price has become a war of words – and dollars – between traditional Wall Street barons and small-time retail investors catalysed by social-media buzz.

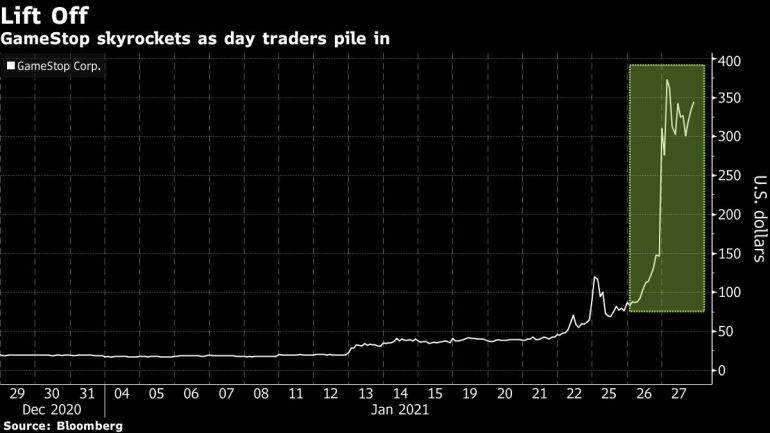

Virtually overnight, the value of GameStop went from extraordinarily low to breathtakingly high. The coronavirus pandemic had slammed the Texas-based chain with more than 5,500 retail locations. Struggling to shift from brick-and-mortar stores to an online seller, the company was shuttering many of its mall shops.

Yet now, the gaming merchandiser is taking a victory lap, just as other companies have also seen their fortunes brought back to life by so-called “Reddit rich” rookies exchanging free stock tips on the social media site.

What is the background here?

In April 2020, Gamestop announced plans to close 450 stores. Its stock dipped to below $3 per share. The stock then slowly recovered by the end of the northern hemisphere summer and in September, investor Ryan Cohen rallied around the retailer, pressing for the company to take on Amazon.com Inc.

Cohen snatched up a 13 percent stake in GameStop and along with two partners, jumped onto the company’s board. That was when the firm’s cult-like status began to emerge.

How much is GameStop now worth?

By mid-January, the stock had surpassed $30 per share. But the momentum did not stop there. During the past week, its value has catapulted past $300 per share, reaching a peak of $373 on Wednesday morning in New York.

[Bloomberg]

[Bloomberg]Why are heads turning?

Small-time investors purchased what they saw as undervalued GameStop stock using the Robinhood mobile app and other new trading services that aim to democratise market access. At the same time, a number of big Wall Street financial players bet against GameStop and shorted the stock.

So please explain to me what shorting a stock is

This is a strategy in which investors borrow shares they do not own and then sell them on the expectation that their price will fall. They then buy those shares back – something known as “covering” – once their price drops and hand the shares back to the party they borrowed them from in the first place. It is essentially the reverse of how an investor would normally try to make money: buying a stock while it is low and selling it when it rises.

More than 70 million GameStop shares are currently being shorted, resulting in losses for large institutional investors amounting to an estimated $6bn.

Is this what experts call a ‘short squeeze’?

Yes, a short squeeze occurs when a stock price sees a rapid increase – not necessarily due to underlying fundamentals – but because of short sellers covering and liquidating their positions.

With GameStop, this began on January 22 and continued this week.

What does this say about the power of Reddit?

On Monday, Reddit users were saying they “broke GME”, referring to the ticker symbol for GameStop. Trading of its shares was temporarily halted by the New York Stock Exchange nine different times to contain the volatility, after the stock doubled in under two hours. Many millennials in the WallStreetBets forum are celebrating their power over Wall Street titans.

Legions of Reddit-inspired stock pickers and a stampede of TikTok-addicted day traders went head-to-head with established investors who doubled down on their opposing bet, in a financial war of attrition. The investors backing GameStop have promoted the face-off as a battle royale between everyday punters and powerful hedge funds.

Social news aggregation site Reddit has become a platform for forums such as WallStreetBets which have allowed retail stock traders to beat much larger investment firms [File: Bloomberg]

Social news aggregation site Reddit has become a platform for forums such as WallStreetBets which have allowed retail stock traders to beat much larger investment firms [File: Bloomberg]Can veteran investors still win their wager?

One conventional investor, Citron Research, continues to refer to GameStop as “failing” and disparages supporters as “herd investors” artificially inflating the stock’s value. But that firm has stopped shorting the shares, reportedly following online harassment by GameStop fans.

Melvin Capital Management, another established player, has seen its assets lose 30 percent as short positions – including those in GameStop – have floundered. But the hedge fund has nonetheless been bailed out in recent days by other funds such as Point72 Asset Management and Citadel LLC. Melvin closed out its short position – in other words, it bought back the shares it had borrowed – in GameStop on Tuesday, as GameStop became the single most-traded stock in the United States.

Many in the mainstream financial media have sided with the seasoned investors, while some analysts condemn the market frenzy as a bull-headed sign of manic trading. Though the short sellers may eventually be forced to fold, sceptics argue that the stock ultimately will return to a valuation consistent with market fundamentals. Regardless, the price movements could take months to reach some kind of equilibrium.

Which other stocks are similarly positioned?

The same Reddit community has been orchestrating this type of manoeuvre with a few other heavily shorted stocks such as AMC Entertainment, Eastman Kodak, Bed Bath & Beyond and video rental firm Blockbuster’s liquidation company. Notably, AMC has been rescued from imminent pandemic-driven bankruptcy as a result.

All of these companies have confronted financial ruin – largely as a result of economic forces beyond their control, in sectors as varied as in-person film viewing, big-box retail and VHS movie rentals. Electronics firm BlackBerry Ltd and fashion retailer Express Inc also experienced apparent short squeezes over the last few days. Sharp upward moves in their shares have flown in the face of bets placed against these embattled companies struggling for solvency.

Theatre company AMC Entertainment has been rescued from imminent pandemic-driven bankruptcy as a result of its recent share price surge [File: Carlo Allegri/Reuters]

Theatre company AMC Entertainment has been rescued from imminent pandemic-driven bankruptcy as a result of its recent share price surge [File: Carlo Allegri/Reuters]But is this fervour creating a market bubble?

Selecting hot individual stocks to quickly buy and sell runs contrary to the long-term strategy of diversifying risk in one’s portfolio that most financial planners advocate. Retail trading platforms TD Ameritrade and Schwab have already restricted trading of GameStop and AMC, as government regulators consider their options for how to limit the potential for significant down-side losses.

Some market watchers think a speculative bubble analogous to the dot-com boom – and subsequent bust – of 2000-2001 is being driven by the likes of WallStreetBets players, while other investors suggest that many of these newly rescued companies were seriously undervalued and due for a comeback.

Article From & Read More ( GameStop: Why social media-driven traders are beating Wall Street - Al Jazeera English )https://ift.tt/3coIT85

Business

Bagikan Berita Ini

0 Response to "GameStop: Why social media-driven traders are beating Wall Street - Al Jazeera English"

Post a Comment