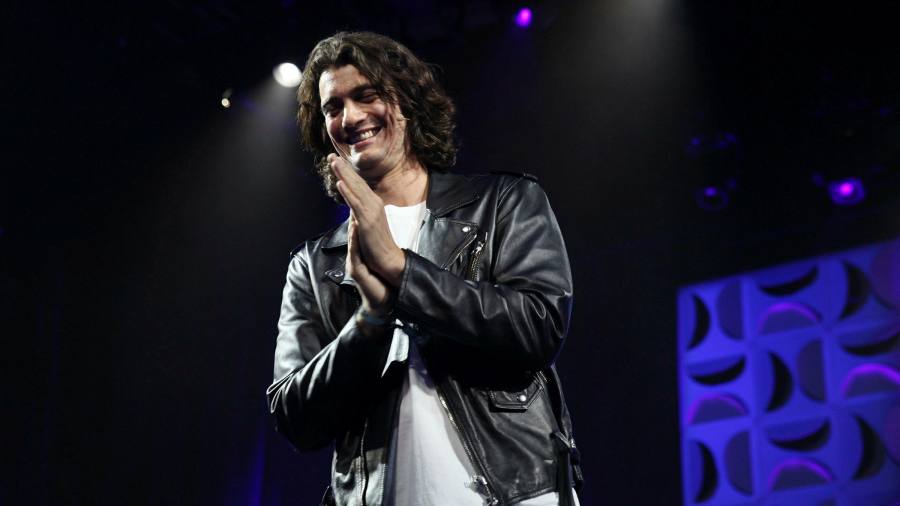

Adam Neumann could reap almost $500m in cash from his holdings in WeWork and emerge with a stake in a public company, less than 18 months after the high-profile failure of its initial public offering cost him his job as chief executive.

SoftBank is in advanced talks with WeWork’s co-founder and other shareholders to settle a bitter legal battle stemming from the Japanese group’s October 2019 rescue of the office group, which was needed to help it avert bankruptcy in the wake of the IPO’s collapse, people familiar with the negotiations said.

Cleaning up the litigation brought by Neumann and a special committee of the group’s independent directors would clear the path for WeWork to be bought by a special purpose acquisition company, giving it the public listing it tried and failed to get in 2019.

People familiar with the matter said BowX Acquisition, a blank cheque vehicle that raised $420m in an IPO in August, had approached SoftBank, WeWork’s largest shareholder, about a deal that could value WeWork at about $10bn.

Talks between the two groups are continuing and a deal could be reached in the weeks ahead, although the negotiations could still fall apart. Resolving the legal fight with Neumann and others has been seen as critical to completing a merger with BowX, given the new public company must attract investors to its shares.

The mooted valuation would be well below the $47bn price tag SoftBank put on the company in its last private funding round before the failed IPO, which Neumann and his Wall Street bankers once hoped would match or eclipse that level.

But it would represent an unexpected rebound in Neumann’s fortunes, an endorsement of a business model that appeared imperilled as the Covid-19 pandemic emptied offices and another indication of how the Spac boom has transformed capital markets.

SoftBank is said to have approached Neumann and the special committee within the past two weeks with a proposal to settle their dispute over a $3bn tender offer that formed part of its October 2019 rescue. The Japanese group had pulled out of the agreement to buy the stock from Neumann and other investors, saying conditions in the deal had not been met.

The opposing sides were due to face off in court next week over the tender offer after an earlier trial gave the special committee and Neumann standing to bring their case against SoftBank.

The settlement under discussion would result in SoftBank paying $1.5bn — half the sum under dispute — to Neumann and other investors including Benchmark Capital. Neumann would receive about $480m for 25 per cent of his holdings, rather than double that for the 50 per cent he could have tendered. He would also retain three-quarters of his current holdings in the public company.

WeWork has retrenched staff and exited more than 100 open and planned locations since its fortunes shifted drastically last year. Under the leadership of chief executive Sandeep Mathrani, the company has dramatically reduced costs, although it continues to lose money.

The talks are continuing and the exact sum Neumann and others receive could change.

BowX is led by Vivek Ranadivé and Murray Rode, two former executives of Tibco Software and backed by Bow Capital, the venture capital fund Ranadivé founded with support from the University of California. In listing documents last year, it said it intended to scout for telecoms, media and technology companies.

Ranadivé also owns the Sacramento Kings basketball team.

The Wall Street Journal earlier reported on the settlement talks.

Article From & Read More ( Dumped WeWork co-founder could reap $500m from Spac deal - Financial Times )https://ift.tt/3dQkyc3

Business

Bagikan Berita Ini

0 Response to "Dumped WeWork co-founder could reap $500m from Spac deal - Financial Times"

Post a Comment